Illuminate Your Game: Billiard Table Lighting Tips

Discover the best lighting solutions for your billiard table to enhance your game and ambiance.

Crypto Regulation Roulette: What’s Your Bet on the Future?

Discover the unpredictable world of crypto regulation! Join the game and place your bets on what the future holds for digital currencies.

Understanding the Global Landscape of Crypto Regulation: Key Players and Trends

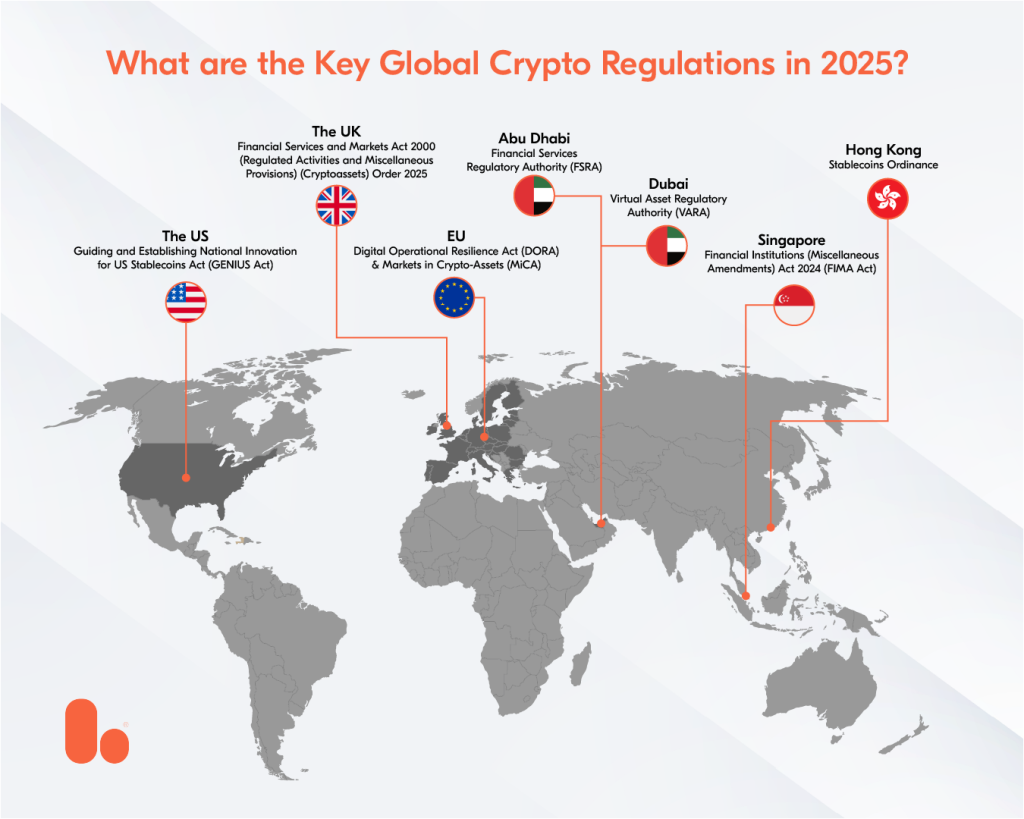

The regulatory environment surrounding cryptocurrencies is rapidly evolving, shaped by various global players with differing approaches to governance. In regions such as the European Union, there is a drive towards comprehensive legislation aimed at creating a unified framework for crypto regulation. This initiative seeks to mitigate risks associated with digital currencies while fostering innovation. Similarly, the United States presents a patchwork of regulations that varies by state, leading to a complex landscape where federal authorities and state regulators engage in continual dialogue to establish a coherent regulatory approach.

Key trends emerging from this global landscape include the increasing emphasis on anti-money laundering (AML) and know your customer (KYC) practices, which aim to enhance transparency within the crypto market. Additionally, the rise of Central Bank Digital Currencies (CBDCs) is prompting governments to rethink their strategies towards traditional cryptocurrencies. According to experts, we can expect further collaboration among international regulatory bodies, such as the Financial Action Task Force (FATF), to promote the establishment of best practices and harmonized standards in crypto regulation.

Counter-Strike is a popular tactical first-person shooter that pits teams of terrorists against counter-terrorists in a variety of game modes. Many players enjoy betting on competitive matches, using platforms that offer promotions such as betpanda promo code. The game's blend of strategy, teamwork, and skill has made it a staple in the esports community.

Will the Future of Crypto Be Decentralized? Exploring Regulatory Impacts

The future of cryptocurrency is often envisioned as a decentralized utopia, where financial transactions occur peer-to-peer without the interference of traditional banking systems. However, the ever-evolving landscape of regulations poses significant challenges to this ideal. As governments around the world recognize the potential tax revenue and consumer protection issues associated with digital currencies, they are increasingly implementing regulatory frameworks that could impact how decentralized finance (DeFi) operates. These regulations may force crypto projects to adapt, creating a tension between innovation and compliance.

Ultimately, the balance between decentralization and regulation will shape the trajectory of the crypto industry. While some argue that regulation is necessary to protect consumers and promote institutional adoption, others believe it could stifle the very essence of what makes cryptocurrency appealing: its ability to operate outside the confines of traditional systems. As we navigate this complex landscape, it is crucial for stakeholders to engage in dialogue about the future of crypto, ensuring that the benefits of decentralization can coexist with necessary safeguards.

How Will Changes in Crypto Regulation Affect Your Investments?

The landscape of cryptocurrency is constantly evolving, and one of the most significant factors impacting your investments is changes in crypto regulation. As governments worldwide scramble to create frameworks that address the unique challenges posed by digital currencies, the implications for investors can be profound. For instance, stricter regulations may enhance consumer protection and reduce fraud, potentially making cryptocurrencies more attractive to mainstream investors. However, such regulations might also lead to increased compliance costs for crypto businesses, which can consequently affect the market dynamics and volatility of your investments.

Furthermore, understanding the landscape of crypto regulation can help you navigate potential risks and opportunities. If certain cryptocurrencies are found to be non-compliant, they may face penalties or bans, leading to significant losses. Conversely, areas with clearer regulations might foster innovation and lead to new investment opportunities. Staying informed about regulatory changes not only helps protect your current investments but also positions you to take advantage of emerging trends in the market.