Illuminate Your Game: Billiard Table Lighting Tips

Discover the best lighting solutions for your billiard table to enhance your game and ambiance.

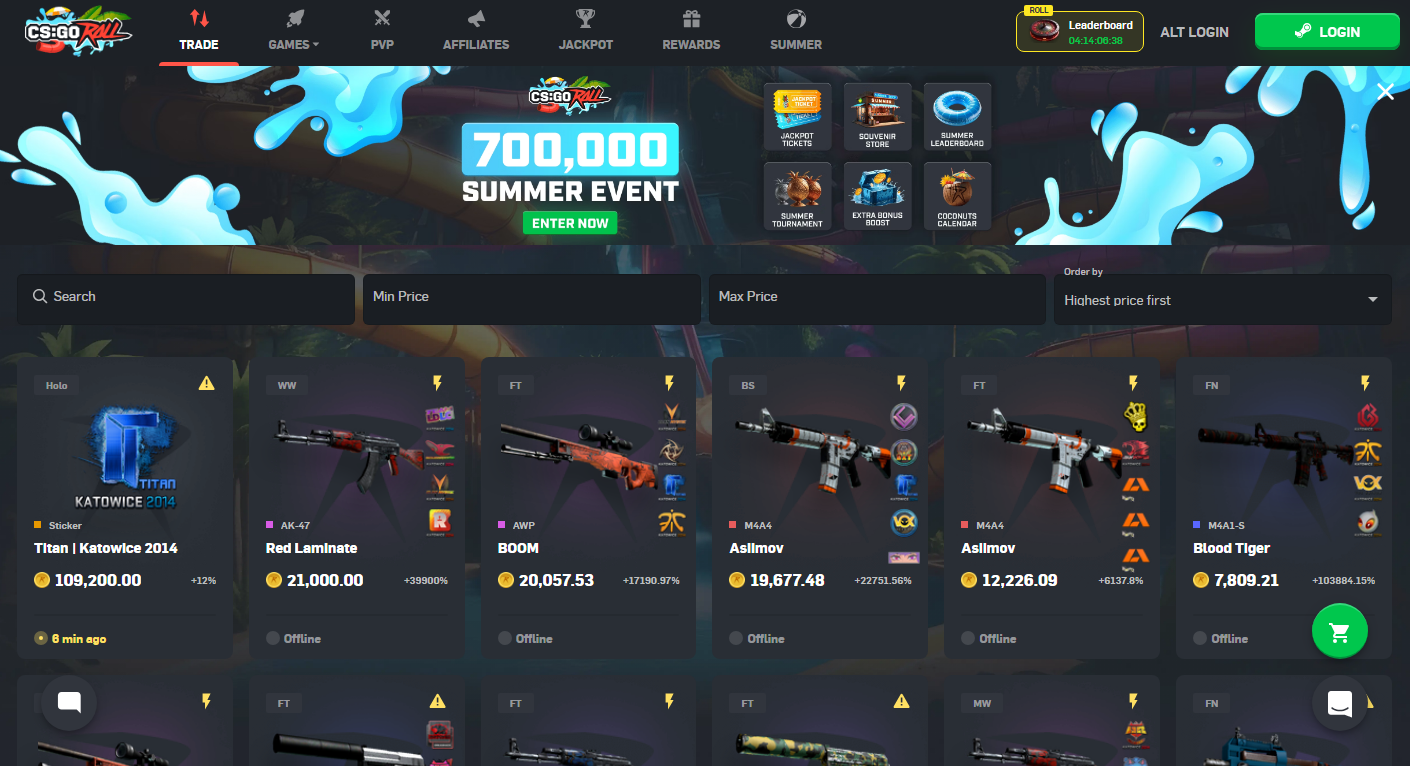

Trade Bots: Your Secret Weapon in CS2 Market Maneuvering

Unlock profit potential with trade bots—your ultimate secret weapon for mastering the CS2 market and outsmarting the competition!

Understanding Trade Bots: How They Work in the CS2 Market

Trade bots are automated software programs that execute buy and sell orders in online markets, including the thriving economy of CS2 (Counter-Strike 2) skins and items. These bots leverage complex algorithms and data analysis to make decisions quickly and efficiently, capitalizing on market trends and price fluctuations. Understanding how these bots operate is crucial for players and traders involved in the CS2 market. They monitor various market indicators and execute trades based on predefined strategies, allowing for a level of trading speed and precision that can be challenging for human traders to achieve.

One of the key features of trade bots is their ability to operate 24/7, ensuring that they can take advantage of every opportunity in the CS2 market. They utilize real-time data to analyze the supply and demand for specific skins, and can make informed decisions about purchasing items at lower prices and selling them for a profit. Additionally, many trade bots come equipped with risk management tools to protect users from significant losses. As more traders turn to automation, understanding how these bots work is essential for anyone looking to succeed in the competitive trading landscape of CS2.

Counter-Strike is a highly popular tactical first-person shooter game series, known for its competitive gameplay and team-based mechanics. Players often eagerly anticipate new updates and versions, and fans are particularly excited to launch CS2 for a fresh experience in the franchise.

Maximizing Profits with Trade Bots: Tips and Strategies

In today's fast-paced trading environment, leveraging trade bots can significantly enhance your profitability. To maximize these profits, it's essential to understand the mechanisms behind these automated systems. Start by choosing a bot that aligns with your trading style—whether it's scalping, day trading, or long-term investing. Next, incorporate risk management strategies into your trading plan. A common approach is to set a maximum drawdown limit and use stop-loss orders. Additionally, consider utilizing backtesting to analyze the bot's performance under various market conditions before deploying it in a live trading scenario.

Another vital aspect of maximizing profits with trade bots is staying updated with market trends and adjusting your strategies accordingly. This can involve regularly reviewing your bot's performance metrics and fine-tuning its settings based on market volatility. Furthermore, keeping an eye on news and events that could impact your trading pair can also provide an advantage. To ensure success, maintain a diversified portfolio and automate your profit-taking strategies. By doing so, you can capitalize on profitable trades while minimizing potential losses.

Are Trade Bots the Future of Market Trading in CS2?

The emergence of trade bots in competitive gaming markets, particularly in CS2, has sparked significant interest among traders and players alike. These automated systems are designed to analyze market data and execute trades with unparalleled speed and efficiency, potentially revolutionizing how players approach in-game economies. With the ability to process vast amounts of information quickly, trade bots can identify profitable opportunities and react to price fluctuations in real-time, ensuring that users don't miss out on lucrative transactions. As they become more sophisticated, the question arises: are trade bots the future of market trading in CS2?

Despite the advantages that trade bots offer, there are also concerns regarding their impact on the marketplace. Many players worry that widespread bot usage could lead to an unbalanced economy, where automated systems dominate trades, leaving traditional players at a disadvantage. Additionally, the risk of market manipulation and unethical practices may increase as more traders turn to these automated solutions. As the CS2 community continues to explore the implications of trade bots, it will be crucial to establish regulations and guidelines to ensure a fair trading environment, fostering healthy competition while utilizing these innovative tools.